What Has Changed?

From July 1st 2021:

All goods sent from the UK to the EU - regardless of value - will now be subject to VAT

Gifts are an exception to these changes for consumers

No VAT or customs charges will apply to gifts under the value of £40/₠45

What Qualifies as a Gift?

Items up to a value of £40/ €45 and sent from one individual to another are considered gifts.

Our Top Tips:

If you're sending an item purchased from an online marketplace - such as eBay or Amazon - even if you mark the item as a 'gift', it will not be considered a gift under the new regulations.

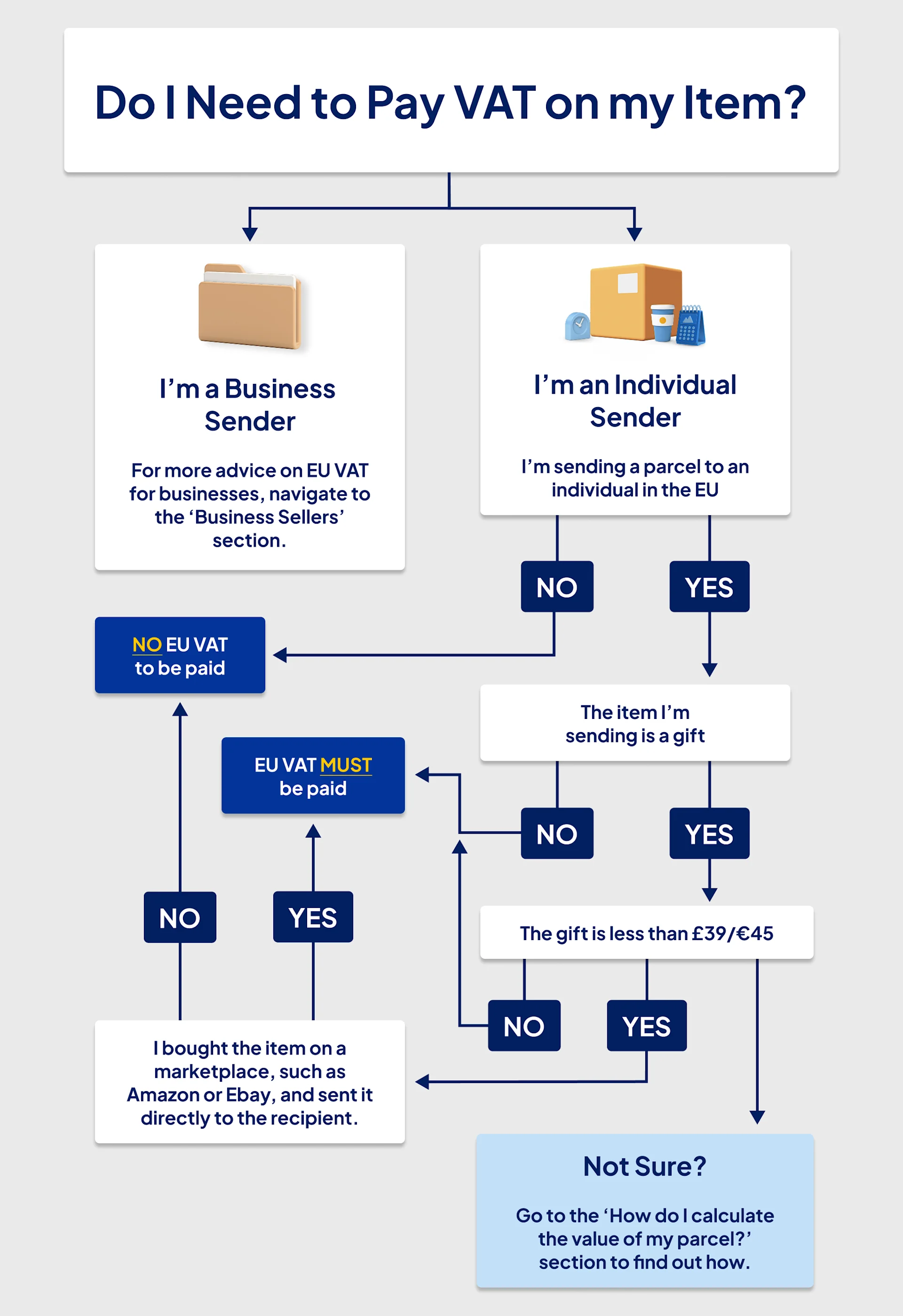

Do I Need to Pay VAT on my Item?

Follow these steps to find out:

Are you sending as a business or an individual?

If you’re a business, see our expert advice here.

If you’re an individual, continue to the next step.

Are you sending the parcel to an individual in the EU?

If no, you don’t need to pay EU VAT.

If yes, proceed to Step 3.

Is the item you’re sending a gift?

If no, you must pay EU VAT on this item.

If yes, continue to Step 4.

Check the value of the gift.

If the gift is worth less than £39/€45, you don’t need to pay EU VAT.

If the gift is worth £39/€45 or more, EU VAT must be paid.

Did you buy your gift under £39/€45 from a marketplace (e.g., Amazon, eBay) and send it directly to the recipient?

If yes, EU VAT must be paid.

How do I Calculate the Value of my Parcel?

For EU VAT purposes, the total value of your parcel is the net price (that's the cost of goods + shipping) you've been charged or are due to pay.

Remember:

Calculating the value of your parcel for VAT purposes is different than adding the value of your parcel contents during the booking process. In the booking process, the value you enter relates only to the contents of the parcel.

For example:

You're sending a £10 book to a friend in Germany as a gift. You enter £10 as the value of your parcel contents in the 'My Parcel Details' section of the booking process.

Next, you want to check if your parcel qualifies as a gift under the new regulations. Let's say the cost of shipping your parcel to Germany is £7.55.You add the value of your parcel contents, £10, to the cost of shipping, £7.55. The total value of your parcel for EU VAT purposes is £17.55, and qualifies as a gift under the new regulations.

VAT Rates by Member State

Sellers can use the delivery address to determine the country VAT rate.

Austria - 20% | Belgium - 21% | Bulgaria - 20% |

Croatia - 25% | Cyprus - 19% | Czech Republic - 21% |

Denmark - 25% | Estonia - 20% | Finland - 24% |

France - 20% | Germany - 19% | Greece - 24% |

Hungary - 27% | Ireland - 23% | Italy - 22% |

Latvia - 21% | Lithuania - 21% | Luxembourg - 17% |

Malta - 18% | Netherlands - 21% | Poland - 23% |

Portugal - 23% | Romania - 19% | Slovakia - 20% |

Slovenia - 22% | Spain - 21% | Sweden - 25% |